About US

We are entrepreneurs at heart and enable clients to create and execute strategies and solutions for their digital transformation journey and taking care of both Business/ Implementation and Service Delivery for RPA, AI & Analytics. An accredited Certified Business and Implementation partner of world’s most leading RPA tools on most of the Tier -1 RPA platforms which augment us to be cognizant of accelerating business operations through process automation to our clients. An organisation with a well-defined road map to the cognitive space of RPA blended with AI. Driven by a leadership team comprising of professionals with 20+ years of hands on business process knowledge in the horizon of verticals and technologies.

We help organizations to embark their automation journey right from the strategy till end to end process automation and ensure the best suitable ROI is achieved. Alzone helps organisation in building RPA Centre of Excellence (RPA CoE) to drive a self-sustainable in-house RPA team. We embed Centre of Excellence (CoE) of RPA, deeply and effectively into our organisation. This helps us to set up distinct Offshore Development Centres (ODCs) with delivery excellence for our clients on most of the tier-1 platforms RPA technology platforms. We have immense experience in handling RPA, AI & Analytics projects in verticals such as BFSI, HealthCare, Supply Chain & Logistics, Oil & Gas, Education, Retailers, Manufacturing etc.

our thought leaders

Anu Achary

Co-Founder & Director

Anu is an innovative solution-driven IT Executive specialized in digital transformation across business verticals globally. He has capitalized his 18 years of techno-process expertise by co-launching the company, and turning it into an internationally recognized Center of Excellence. He is a result-oriented technology ambassador and the growth catalyst behind the proven history of client’s success as well as the productive energy of team.

As Executive Chairman, Anu has built a strong foundation for the company by building their business strategy, capital funds and leadership team. He has ideated the engineering concepts, technology assets and standards of the company, and steers to the next level through his strategic foresights and determination. As a leader and self-sufficient innovator, he provides creative solutions for problems ranging from technical to tactical, and guides the board of directors and executives to advance the revenue and market value of the company. Prior to Alzone, Anu was working with Duckcreek technologies, NTTData and Infosys Ltd in various positions and assignments across United states.

Lijith. A K

CEO & Co-Founder

Lijith has built a strong and committed attitude to addressing challenges in technology and helping organisations realize business value via digital transformation. His leadership, vision and innovation skills landed him in co-founding Alzone Software. His continued focus on aligning the business goals and profitability led Alzone to emerge as a strong player in Digital Transformation technologies across the world. Drawing on deep expertise in technology advancement, he strives to help companies shape strategies to leverage new technologies and bring down the cost of business process operations over 18 years in his career.

He has been instrumental in creating sales strategies that aligns with the company’s revenue growth. Prior to his entrepreneurial journey with Alzone Software, Lijith spent nearly a decade in the US with IT MNCs like IBM, driving the digital transformation journey for Fortune 500 clients. A powerful decision maker recognized for high levels of productivity and attention to detail, he works autonomously and effectively with diverse personalities. Lijith holds a Masters degree in Computer Applications from Anna University, Tamilnadu and a Bachelor’s degree in Physics from University of Kerala, India.

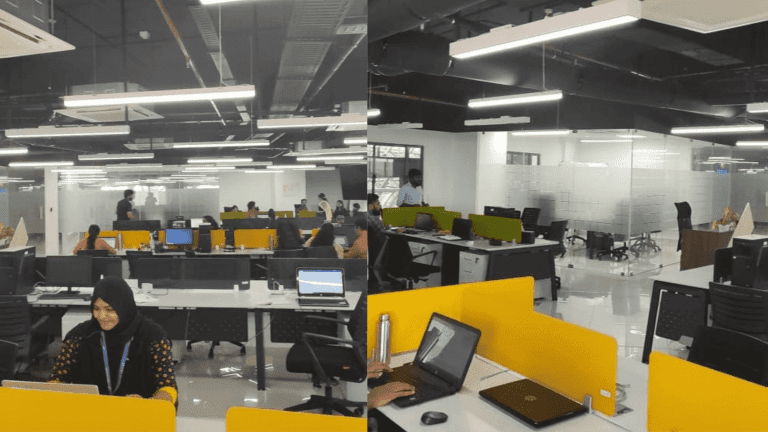

professional team

SOLUTION ARCHITECT

Provide overall guidance to RPA/AI enterprise implementation irrespective of any RPA Technology platforms.

RPA PROGRAM MANAGER(RPM)

To build the peripheral vision required for enterprise-level RPA adoption, strategy and scale.

PROCESS ENGINEERING CONSULANT

Takes the ownership on executing requirement analysis for RPA implementation projects

RPA service company

#rpaservicecompany #rpaservicecompanyindubai #intelligentautomationserviceprovider #rpasolution #rpaserviceprovider #rpaservicecompanyinkerala #rpaservicecompanyinusa #rpaservicecompanyinuae